Introduction: In recent times, crude oil has experienced a boost, leading to a sustained strength in the prices of polyester dual raw materials. However, due to insufficient downstream follow-up and cautious chasing of price increases, the upward momentum in the prices of polyester bottle flakes has been hampered, resulting in intensified industry profit losses.

Market lacks upward momentum:

July’s continuous rise in crude oil prices directly drove up the prices of polyester raw materials. In addition, the supply and demand of polyester performed well, with strong capital pushing for price increases. The main raw material, PTA, showed a robust performance. In the East China market, spot prices rose from 5,670 yuan/ton at the beginning of the month to 5,976 yuan/ton, a 5.40% increase. There was a partial tightness in the supply of goods, leading to traders, end-users, and some downstream major factories making low-priced purchases for near-term supply, with concentrated purchases occurring around last Friday. After prices reached a high level this week, the sentiment for end-user purchases weakened, resulting in sluggish trading. Considering the sustained increase in costs, some traders sold short. As of the closing on July 14th, the spot price of polyester bottle flakes in the East China market was 7,025 yuan/ton, a 2.18% increase compared to July 3rd.

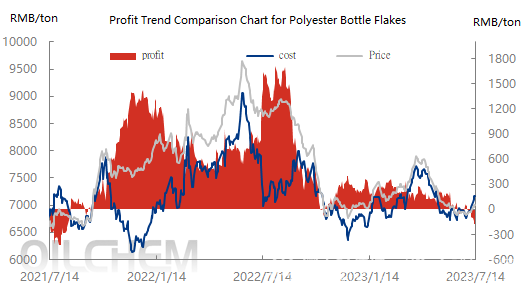

Industry profit losses intensify

As of July 14th, the profit of the polyester bottle flakes industry was -199.61 yuan/ton, a decrease of 934.25% compared to July 3rd. In the first half of the year, the supply side of polyester bottle flakes added a total of 1.95 million tons of new capacity, which is currently running stably. From July 1st to 14th, the new capacity contributed approximately 75,000 tons to the market. Looking at the demand side, the soft drink industry maintained stable growth due to high levels of tourism and travel, while the incremental growth in sheet material and other packaging industries and the edible oil industry was limited compared to the same period in previous years. Although there is no specific data supporting the incremental demand, it can be inferred from the shipments of bottle flake factories that the demand increment is not as significant as the supply increment. Therefore, industry profits have been greatly compressed.

In the short term, raw materials are likely to remain strong, and as for the demand side, the performance of the domestic peak season can only maintain the current situation. If the increase in foreign trade can offset the increase in supply, the negative profit situation in the polyester bottle flakes industry may improve. However, based on the current performance of foreign trade, the negative profit situation in the industry may continue for some time.